Wednesday, August 21, 2013

The drive to non-manufacturing payrolls (NMP)

It used to take a large percentage of the population working on farms to produce food. Technology and processes kept improving until the only a small percentage was needed. Today, agriculture employment accounts for roughly 1.5% of total employment. Agriculture employment is so insignificant to the general economy that the most important employment related economic release doesn't even count farm employment, the non-farm payroll report (NFP).

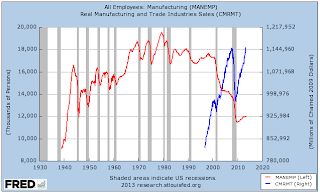

The US is now producing the same real value of manufactured goods as a few years ago with a lot fewer employees. Manufacturing employment is down about 33% from the peak around 1980. The same technology improvements that eliminated farm jobs appear to be hard at work on manufacturing jobs. Some day in the future, we may be getting the non-manufacturing payroll (NMP) report instead of the non-farm payroll report.

I gotta wear a welding mask

The retail news over the last week has been so bright that "shades" aren't strong enough to protect my eyes from the blinding light. I gotta wear a welding mask.

Target profit down 13%

Staples's net drops 15%; company cuts year view

American Eagle Outfitters issues downbeat outlook

Wal-Mart drop in sales reveals a tale of two consumers

Those are the retailers that are doing well. Sick retailers like JC Penney are bleeding cash from every orifice and may not survive the next year.

J.C. Penney reports Q2 loss of $586 million

There is always some creative destruction going on, but when the strong, healthy businesses start to turn down, well, it smells like a business cycle even through the Fed has not approved any future business cycles in their minutes. note: this post is laced with sarcasm

Target profit down 13%

Staples's net drops 15%; company cuts year view

American Eagle Outfitters issues downbeat outlook

Wal-Mart drop in sales reveals a tale of two consumers

Those are the retailers that are doing well. Sick retailers like JC Penney are bleeding cash from every orifice and may not survive the next year.

J.C. Penney reports Q2 loss of $586 million

There is always some creative destruction going on, but when the strong, healthy businesses start to turn down, well, it smells like a business cycle even through the Fed has not approved any future business cycles in their minutes. note: this post is laced with sarcasm

Monday, August 19, 2013

Monetary Base vs M1

In 2008, something strange happened with US money. The monetary base (M0) was inflated above the circulating cash and checking account money (M1). As far as I know, this had never happened before since the Federal Reserve was created in 1913. While M1 has grown since 2008, the velocity of M1, how fast it circulates, has dramatically slowed down. It appears people like having extra cash on hand, but those that have it, don't spend it.

Most of the monetary base money has been created in Federal Reserve computers to purchase bonds, mortgage backed securities, and to run the various Fed bailout programs. Large banks tend to get most of that money, which they promptly deposit back into the Fed as excess reserves, so all that money isn't creating inflation. Theoretically, all those reserves could be turned into roughly $25 trillion in new checking account money (through loans), and could create inflation greater than anything seen in the 1970s. That is all theory. In practice, the reserves are sitting idle collecting 25bps in risk free interest.

I have no idea when or if that huge monetary base will impact the real economy, but it, along with a $4-5 trillion balance sheet will be among the problems inherited by the next Fed Chair in 2014. Next year, get ready for a surprise!

Wednesday, August 14, 2013

Federal Deficit vs. Fed Assets

It's too bad the St. Louis Fed system doesn't offer data on Federal Reserve assets prior to 2002, but looking at the data from other sources, the red line (Federal Reserve assets) were always lower. As the recession in 2008 approached, the Federal Reserve had about $800 billion in mostly short term treasuries and $0 in mortgage backed securities (MBS).

When the gigantic fraud of the housing bubble crashed the real economy, it left a gaping hole in GDP and federal tax receipts. It turns out that millions of fired workers don't pay much income tax, but do collect lots of benefits. Annual trillion dollar money holes are hard to fill. That's where the Fed rides to the rescue, purchasing treasuries of all maturities and MBS in 12 and 13-digit quantities every year since then.

While the deficit has bottomed and is improving, it is still a giant hole that, current course and speed, may get back to zero around 2018. That would leave the Fed with an estimated $5 trillion in marketable treasuries and MBS. That sounds like a lot for a bank with $5 billion in capital. Luckily, accounting rules and being insolvent don't matter for the Fed since they pass losses (and gains) back to the US Treasury.

Maybe my vision is blurry, but that chart looks unstable to me. It doesn't look self correcting or like it will get back in balance any time soon. It looks like something where errors are being magnified, instead of damped, causing the errors to grow exponentially. But everyone can rest easy, because these top market strategists shared their top stock picks on CNBC today.

Monday, August 12, 2013

Blackpalm or Palmberry?

News from Blackberry this morning that they may try to take the company private.

If HP acquires Blackberry, they could fuse the two technologies and release a Blackpalm device! I already have the catchphrase: "Cooler than frostbite" since frostbite also turns your extremities black. Or they could go with the friendlier "Palmberry", but I am not sure they want to evoke that kind of visual. Either way, I would expect one product release before it dies.

CEO Thorsten Heins might think that running BlackBerry's turnaround as a private company would be easier. After all, upset shareholders would be a thing of the past. The company could also get away with not having to disclose total smartphone unit sales and have to publicly disclose its revenue and earnings (or losses) as often.Well, that sounds like a winning strategy. I suggest they sell themselves to HP, which is where many technology companies go to die. Palm was acquired by HP in 2007 and after one new product release, was euthanized.

If HP acquires Blackberry, they could fuse the two technologies and release a Blackpalm device! I already have the catchphrase: "Cooler than frostbite" since frostbite also turns your extremities black. Or they could go with the friendlier "Palmberry", but I am not sure they want to evoke that kind of visual. Either way, I would expect one product release before it dies.

Subjective Invective v.9

From the WSJ:

The reality is that debt payments must be made, and pretending government finances are fine by excluding them is a strange exercise in fantasy. Economists nurture a similar fantasy that sovereign debt never has to be repaid, and can be rolled over forever, when there are numerous examples to the contrary throughout history.

In my opinion, Japan is still in the pole position for the Keynesian end game winner. Developed western nations are quickly following the Japanese fiscal leadership of infinite debt and economic stagnation. Don't change that dial, the finish is likely to be spectacular!

ATHENS—Greece's fiscal discipline efforts appear to be paying off, according to budget data released Monday, with a primary surplus that may help make the country's case for further debt relief from international creditors.I am not sure why economists invented the term "primary surplus", except to make government budget appear better than they are. The idea of a primary surplus or primary deficit is that it excludes interest payments on debt, and usually other real expenses such as social security payments.

But the steep spending cuts brought about by the fiscal discipline have come at a huge price for the country. The economy contracted by 4.6% in the second quarter, albeit at a slower pace than previous quarters, raising doubts as to whether it will be able to return to growth in 2014 and start lowering record high unemployment rates.

The reality is that debt payments must be made, and pretending government finances are fine by excluding them is a strange exercise in fantasy. Economists nurture a similar fantasy that sovereign debt never has to be repaid, and can be rolled over forever, when there are numerous examples to the contrary throughout history.

In my opinion, Japan is still in the pole position for the Keynesian end game winner. Developed western nations are quickly following the Japanese fiscal leadership of infinite debt and economic stagnation. Don't change that dial, the finish is likely to be spectacular!

Sunday, August 11, 2013

Gold vs US Debt since 1971

The correlation of the gold price to the rapid debt increase since 2001 failed early this year. However, the long term correlation since 1971 appears to be back in play. The adjusted R-squared is 0.84 and the price is back within one sigma to the down side. Official US debt has not grown since May 31, 2013 and in fact dropped through May. The Treasury is using emergency procedures to manage payments until Congress passes another debt ceiling increase. Then, it will continue the inexorable climb toward infinity (see Japan). Economists generally acknowledge that sovereign debt is never meant to be paid back, only rolled forever. That works until a country runs out of credit. I am not predicting the US will run out of credit soon, but I do think there is some limit. Camels, straws, you know the story.

Here are the linear regression predictions:

Best Fit Price: $1467.56

One sigma up: $1672.72

One sigma down: $1262.39

Two sigma up: $1887.02

Two sigma down: $1048.09

Here are the linear regression predictions:

Best Fit Price: $1467.56

One sigma up: $1672.72

One sigma down: $1262.39

Two sigma up: $1887.02

Two sigma down: $1048.09

Friday, August 2, 2013

Battle of the [Interest] Bulge

US Treasury interest rates, especially the 5,7, and 10 year flavors, continue to flail upward. Since my last post in mid-June, the net change has been:

5-year 1.36 +12bps

7-year 2.01 +25bps

10-year 2.63 +30bps

My guess is that the psychology of a rising stock market, bleating from the financial press about the danger of rising rates (and they have been rising), and the Fed's taper talk, has convinced some people to move their money out of bonds and into stocks. This move has gained momentum despite ongoing weak economic data. Housing has had a good year, but with rising rates and higher prices, it has been slowing down.

I think this psychology is temporary, but I don't know when it will be played out. A real spike in rates may happen when the world figures out that the large US trade deficit is permanent and that the US oil production increase is brief and temporary. Before that, I expect Japan to blow up in a huge financial fireball. They have been leading the world for a couple of decades and I believe their fate is the fate of all countries that follow, including the US.

5-year 1.36 +12bps

7-year 2.01 +25bps

10-year 2.63 +30bps

My guess is that the psychology of a rising stock market, bleating from the financial press about the danger of rising rates (and they have been rising), and the Fed's taper talk, has convinced some people to move their money out of bonds and into stocks. This move has gained momentum despite ongoing weak economic data. Housing has had a good year, but with rising rates and higher prices, it has been slowing down.

I think this psychology is temporary, but I don't know when it will be played out. A real spike in rates may happen when the world figures out that the large US trade deficit is permanent and that the US oil production increase is brief and temporary. Before that, I expect Japan to blow up in a huge financial fireball. They have been leading the world for a couple of decades and I believe their fate is the fate of all countries that follow, including the US.

Subscribe to:

Posts (Atom)